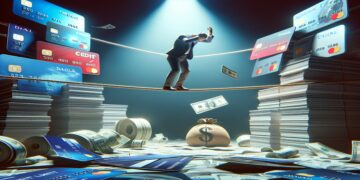

The difference between using a credit card intentionally or out of habit.

This article explores the crucial distinction between intentional and habitual credit card usage. By adopting mindful spending habits, consumers can enhance their financial health, build credit, and unlock rewards. In contrast, habitual use often leads to debt and diminished financial awareness, highlighting the importance of intentionality in credit management.

Credit Card as a Tool for Building Healthy Credit

Credit cards are powerful financial tools for building a healthy credit history when used responsibly. Key strategies include making timely payments, managing credit utilization, and leveraging rewards. Understanding different card types and monitoring credit reports can further enhance financial health, paving the way for better loan terms and financial opportunities.

Techniques for Maintaining Emotional Control When Using a Credit Card

The article explores the psychological aspects of credit card usage, highlighting the importance of emotional control in financial decision-making. It offers practical strategies like setting budgets, delaying purchases, and engaging in self-reflection to combat impulsive spending and foster healthier financial habits for long-term stability.

How to Monitor Your Credit Card Spending Without Surprises

Managing credit card spending is essential for financial well-being. By utilizing budgeting techniques, tracking expenses through apps, and setting alerts, individuals can prevent debt and improve financial discipline. Adopting proactive habits helps minimize surprises and promotes a stable financial future, empowering smarter spending decisions.

Why paying the minimum on your bill is a dangerous trap

Many consumers fall into the trap of paying only the minimum on their bills, leading to high interest accumulation and prolonged debt. This strategy can severely impact credit scores, financial goals, and mental well-being. Understanding its hidden costs is essential for breaking free and achieving financial stability.

How to Create Personal Rules for Using a Credit Card

Navigating credit card use effectively requires personal rules for spending limits, purpose, and payment strategies. Establish guidelines to maximize rewards, avoid debt, and foster accountability, ensuring flexibility as financial situations change. A proactive approach can enhance financial health and reduce stress over credit management.

The psychological impact of a high credit limit

High credit limits offer financial freedom and perceived empowerment but can also lead to anxiety, overspending, and strained relationships. Balancing the advantages with emotional awareness is crucial for fostering a healthy relationship with credit, promoting mindful spending and proper management to mitigate psychological burdens.

How to choose the ideal credit card for your spending profile

This article guides readers on selecting the perfect credit card by assessing spending patterns, evaluating rewards, and understanding fees. It emphasizes the importance of aligning a card with financial goals and spending habits, ensuring readers make informed decisions to enhance their financial health.

Behavioral strategies to avoid excessive use of credit cards

Credit card usage can lead to excessive spending and financial instability. The article offers behavioral strategies to promote responsible habits, such as budgeting, tracking expenses, and delaying purchases. By establishing boundaries and fostering mindful spending, individuals can enhance financial health and transform credit cards into valuable assets.

How to Use Credit Cards Smartly Without Going Into Debt

This article explores the intelligent use of credit cards, highlighting their benefits like rewards and credit building, while cautioning against risks such as high-interest rates and overspending. It offers strategic tips for maximizing rewards, managing finances effectively, and enhancing financial literacy to avoid debt.